Fending off GST audits means taking steps to prevent or minimize the risk of being selected for a GST audit by tax authorities. This includes maintaining accurate records, filing complete and timely GST returns, understanding GST laws and regulations, conducting self-audits, seeking professional advice, maintaining good communication with tax authorities, and implementing internal controls to ensure GST compliance. By following these tips, businesses can reduce the chances of being audited and be better prepared in case an audit is conducted.

Here are some tips on how to fend off GST audits:

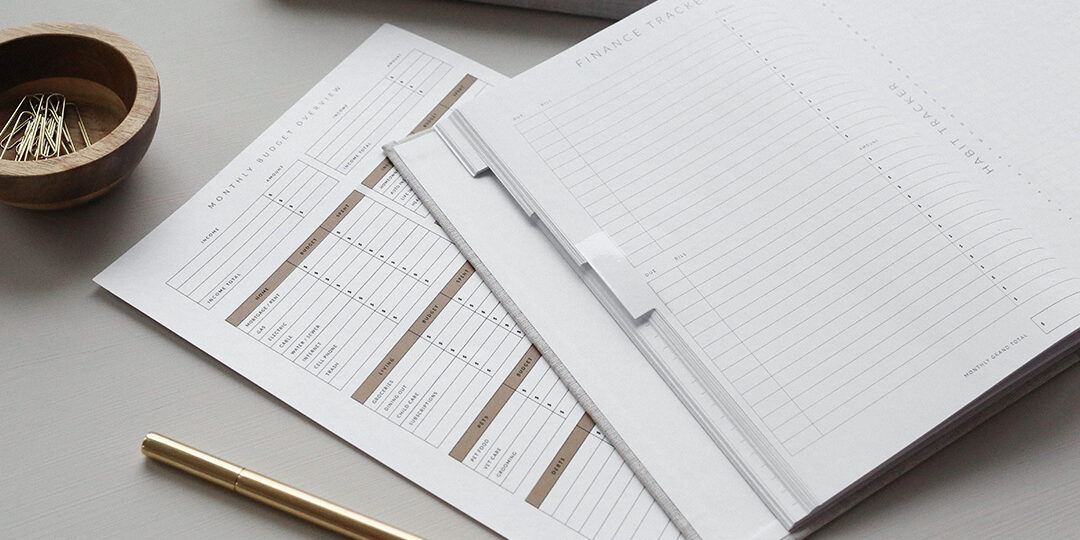

- Keep accurate records: Maintain detailed and accurate records of all transactions, including invoices, receipts, and other supporting documents.

- Be timely and complete with your GST returns: File your GST returns on time and ensure that they are complete and accurate. Late or incomplete returns can trigger an audit.

- Understand GST laws and regulations: Stay up-to-date on GST laws and regulations and ensure that you are complying with them.

- Conduct self-audits: Conduct regular self-audits to identify and address any potential compliance issues before they are detected by tax authorities.

- Seek professional advice: Consult with a tax professional to ensure that you are following the best practices for GST compliance.

- Maintain good communication with tax authorities: Respond promptly to any inquiries from tax authorities and maintain good communication with them.

- Implement internal controls: Implement internal controls to ensure that GST compliance is integrated into your business processes.

By following these tips, you can reduce the risk of being selected for a GST audit and be better prepared in case an audit is conducted.

Contact the team at Tax Store Mackay or visit ATO for information on GST audits and GST compliance.